The Facts About Succentrix Business Advisors Revealed

The Facts About Succentrix Business Advisors Revealed

Blog Article

Succentrix Business Advisors Things To Know Before You Get This

Table of ContentsThe Single Strategy To Use For Succentrix Business Advisors9 Simple Techniques For Succentrix Business AdvisorsA Biased View of Succentrix Business AdvisorsSuccentrix Business Advisors Fundamentals ExplainedWhat Does Succentrix Business Advisors Do?

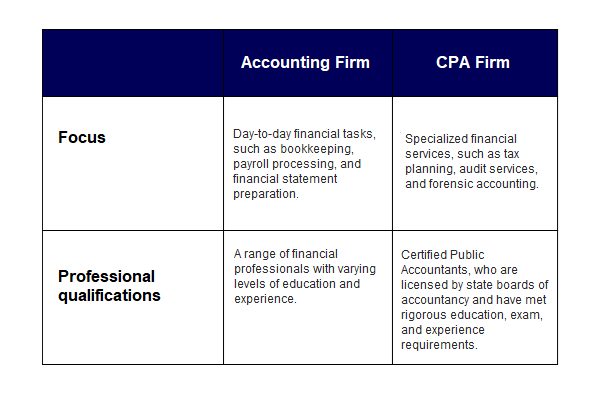

Getty Images/ sturti Contracting out audit services can free up your time, protect against errors and even decrease your tax expense. Or, possibly you desire to manage your general audit tasks, like accounts receivables, yet hire an expert for cash flow projecting.Discover the various kinds of audit solutions readily available and find out exactly how to pick the appropriate one for your small company requirements. Bookkeeping solutions drop under basic or economic bookkeeping. General accountancy refers to regular obligations, such as recording purchases, whereas monetary accounting plans for future growth. You can employ an accountant to get in information and run reports or work with a CPA who provides financial recommendations.

Prepare and submit tax obligation returns, make quarterly tax obligation repayments, file expansions and deal with IRS audits. Generate financial statements, including the balance sheet, revenue and loss (P&L), money flow, and earnings statements.

Succentrix Business Advisors Fundamentals Explained

Track job hours, determine earnings, withhold taxes, problem checks to employees and make certain accuracy. Bookkeeping services may likewise consist of making pay-roll tax obligation payments. Additionally, you can hire specialists to design and establish your bookkeeping system, offer monetary planning suggestions and describe monetary declarations. You can contract out chief economic police officer (CFO) services, such as sequence preparation and oversight of mergings and procurements.

Frequently, small company proprietors outsource tax obligation solutions first and include payroll assistance as their firm grows. According to the National Local Business Organization (NSBA) Local Business Taxation Survey, 68% of participants make use of an exterior tax obligation specialist or accountant to prepare their firm's tax obligations. On the other hand, the NSBA's Technology and Service Study located that 55% of tiny organization proprietors take care of pay-roll online, and 88% manage banking accounts electronically.

Next, it's time to discover the best bookkeeping solution carrier. Currently that you have a concept of what type of audit services you require, the question is, who should you work with to supply them?

The Greatest Guide To Succentrix Business Advisors

Prior to deciding, think about these questions: Do you desire a local accountancy specialist, or are click this you comfortable functioning essentially? Should your outsourced services integrate with existing audit tools? Do you need a mobile app or online site to supervise your bookkeeping solutions?

Use for a Pure Leaf Tea Break Give The Pure Fallen Leave Tea Break Grants Program for little organizations and 501( c)( 3) nonprofits is currently open! Concepts can be new or already underway, can come from HR, C-level, or the frontline- as long as they improve staff member well-being with culture change.

Something failed. Wait a moment and attempt once again Try once again.

Keeping up with ever-evolving accountancy standards and regulatory demands is critical for services. Accountancy Advisory professionals help in economic reporting, making sure precise and certified financial declarations.

Indicators on Succentrix Business Advisors You Should Know

Below's an in-depth consider these vital abilities: Analytical skills is an important ability of Accountancy Advisory Providers. You should be competent in event and analyzing monetary information, attracting significant insights, and making data-driven suggestions. These skills will allow you to examine monetary performance, determine fads, and offer notified advice to your customers.

Connecting successfully to customers is an essential ability every accounting professional should possess. You should be able to share complicated economic info and insights to clients and stakeholders in a clear, easy to understand fashion. This consists of the capacity to convert financial lingo right into plain language, develop comprehensive reports, and deliver impactful presentations.

Some Known Incorrect Statements About Succentrix Business Advisors

Accounting Advisory companies use modeling methods to simulate various financial scenarios, examine possible results, and support decision-making. Proficiency in economic modeling is important for accurate forecasting and calculated planning. As an audit consultatory company you need to be fluent in economic policies, accountancy requirements, and tax obligation legislations pertinent to your customers' industries.

Report this page